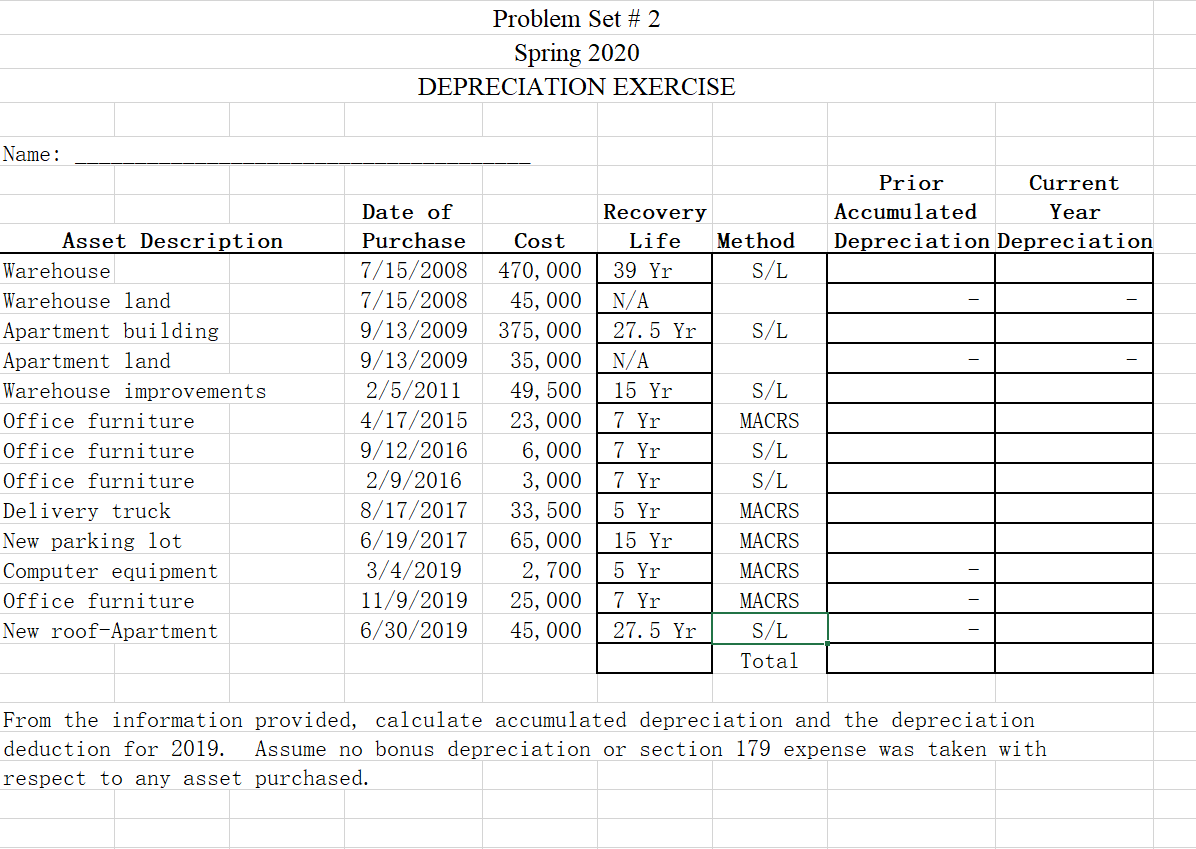

New Roof Depreciation 2019

These new limits are effective for properties placed in service in taxable years beginning after dec.

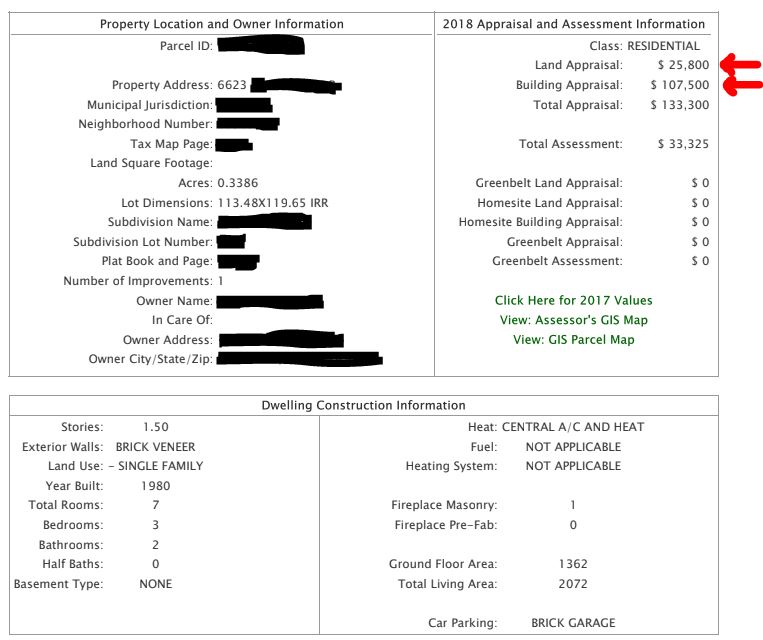

New roof depreciation 2019. Is generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property. There are several different types of equipment that are eligible for the deduction including new roofing. 1 2018 remains at. The new tax law adds commercial roofs to section 179 property and doubles the deduction to 1 million.

We replaced the roof with all new materials replaced all the gutters replaced all the windows and doors replaced the furnace and painted the property s exteriors. Bonus depreciation is being offered at 100 in 2018 and can be applied to equipment expenses that go beyond the 2 5 million spending cap. Refer to the section 179 website to view the qualifying equipment. 31 2017 and the amounts will be indexed for inflation starting in 2019.

If you have a commercial roof tax planning for 2019 as it relates to your budget process is different than it was in 2018. The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time. 28 2017 and placed in service before jan. The new law increases the bonus depreciation percentage from 50 percent to 100 percent for qualified property acquired and placed in service after sept.

The new law also reduces the commercial roof depreciation schedule from 39 years to 25 years which is much more realistic. In addition the tax cuts and jobs act expanded the definition of qualified real property eligible for section 179 to include improvements to nonresidential roofs.